The Federal Reserve said late Friday that a set of confidential staff economic forecasts inadvertently posted online included erroneous information, compounding a blunder that had already begun to raise questions about the central bank’s handling of sensitive data.

The secret data was originally posted to the Fed’s website June 29 encrypted in the computer code used in the central bank’s model of the U.S. economy. A Fed employee spotted the breach earlier this week, and on Friday morning, the Fed publicly identified the confidential information as economic projections prepared by staff for the central bank’s June policy-setting meeting. The Fed republished the encrypted data in a more user-friendly table.

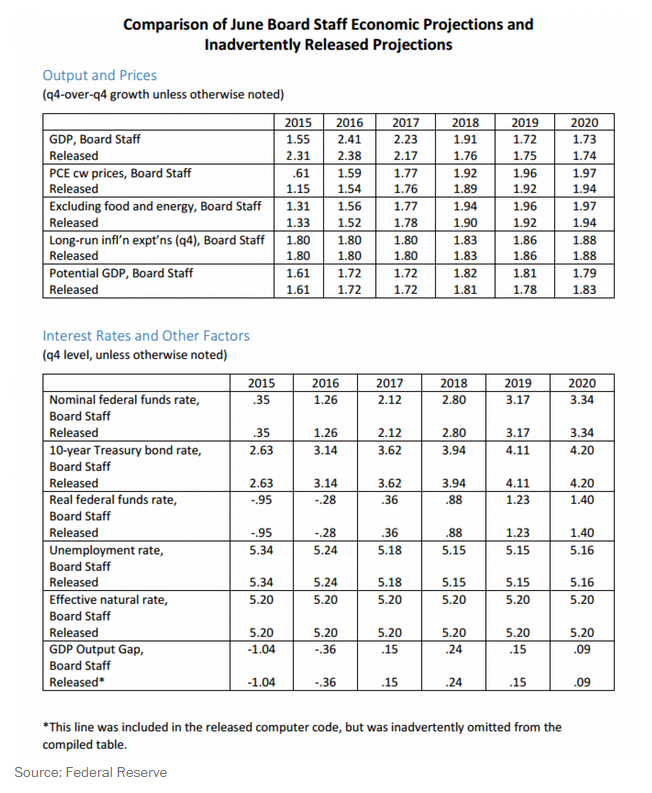

But late Friday, the central bank revealed that some of the data actually was not part of the staff’s economic projections. In the data inadvertently posted online, for example, the GDP forecast for 2015 is 2.31 percent. The actual staff projection presented to the Fed’s policymakers in June was 1.55 percent. There was also a substantial difference in the forecasts for inflation and smaller discrepancies in estimates of potential GDP.

But other information was spot-on. The estimate of the prevailing level of the influential fed funds rate during the fourth quarter was 35 basis points in the data published online as well as in the staff forecast.

It was unclear late Friday what the inaccurate numbers represented — or even if they represented anything at all. A Fed official said that the erroneous data was not part of any staff projections and had never been presented to the Fed’s policy-setting committee. The central bank said it is looking into the source of the discrepancy. The Fed has alerted its inspector general of the breach.

The central bank has been dogged in recent years by allegations that it has mishandled sensitive information. Fed decisions have the power to dramatically move financial markets, and investors regularly parse every morsel of information from the central bank for clues to what it will do. The data breaches raise the possibility that some firms could profit inappropriately from central bank mistakes.

“It regrettably appears once again that proper internal controls are not in place to safeguard confidential Federal Reserve information. To say these recurring leaks at the Fed are troubling is a serious understatement and points to the urgent need for accountability reforms,” said Rep. Jeb Hensarling (R-Texas), head of the Financial Services committee.

Hensarling has subpoenaed the Fed for documents relating to its policy-setting meeting in 2012 and accusations that central bank officials leaked information to financial services firm Medley Global Advisors. The Fed is under investigation by its inspector general and the Justice Department over the matter. In 2013, the central bank accidentally sent minutes of its March meeting to members of Congress a day before they were scheduled for publication. And the Fed has tightened its rules for releasing information to reporters after questions arose over how quickly information could be transmitted to traders in different parts of the country.

A Fed spokesperson said the central bank is looking at setting up more robust security protocols.