WASHINGTON (MarketWatch) — In gleeful news for ardent Federal Reserve observers (and an embarrassment for officials), the central bank accidentally published internal staff forecasts for interest rates, unemployment and other key indicators, the Fed revealed Friday.

Normally, the Fed would have published those forecast details in five years from now. But, thanks to a slip-up, the staff forecasts were added to the Fed’s public site on June 29, and markets are getting an early look at estimates provided to officials in preparation for their meeting last month.

In an additional complication, the Fed said late Friday that some of the projections posted online in late June differed from the actual staff projections prepared ahead of the June policy meeting. The Fed released the actual staff projections and said it was looking into the source of the incorrect information.

Some economists weren’t favorably impressed by the staff’s work.

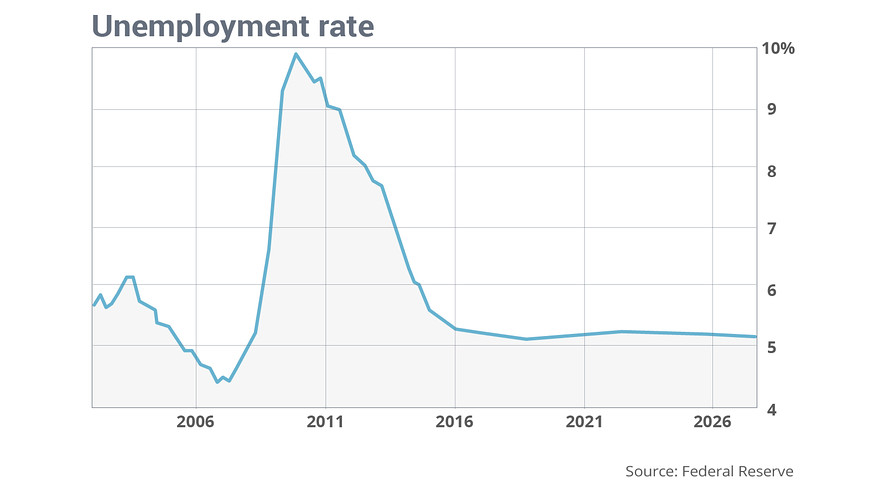

“As I look at the forecast, I can’t help but conclude that all of these Ph.D. economists on the board staff are wasting a lot of time running these models,” wrote Stephen Stanley, chief economist at Amherst Pierpont Securities, in a research note. “How can real growth exceed potential by over half a percent for the next three years, but the unemployment rate magically stabilizes at exactly the full employment level?”

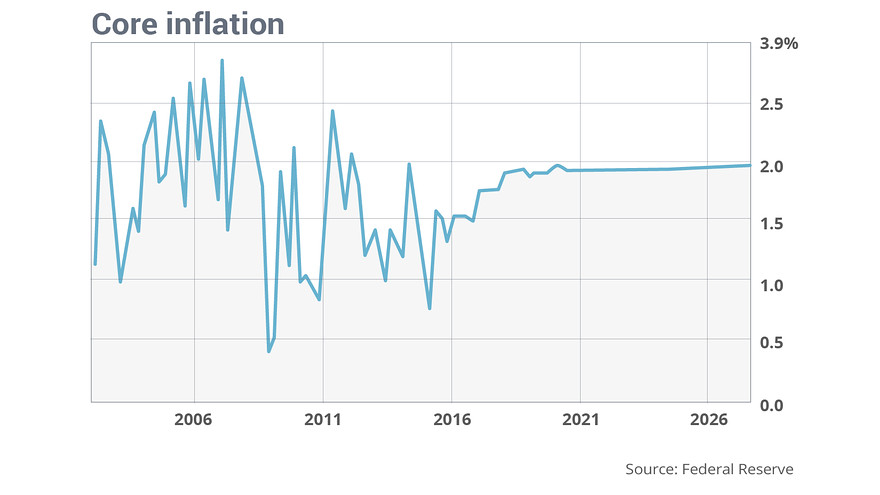

Details show that the staff is forcing the model to “spit out” forecasts that show upcoming inflation under 2%, Stanley wrote.

“Do you get the impression, as I do, that the staff gathers in a room and decides what the results should be, and then tortures the model (or just uses fudge factors) until they get to the results that they were determined to achieve? Why bother with extensive, complicated models if you are just going to manipulate the results,” Stanley wrote. “Because the model provides at least the illusion of rigor and objectivity.”

Robert Brusca, chief economist with FAO Economics, echoed those sentiments.

“Core inflation homes in on 2% — perfect!” Brusca wrote. “These are interesting policy assumptions by the Fed.”

He added that the leaked information shows that forecasting is a farce: “It’s an important farce, but a farce nonetheless,” Brusca said. “In this case the Fed seems to wind up assuming that it achieves what it wants to achieve. Good job.”

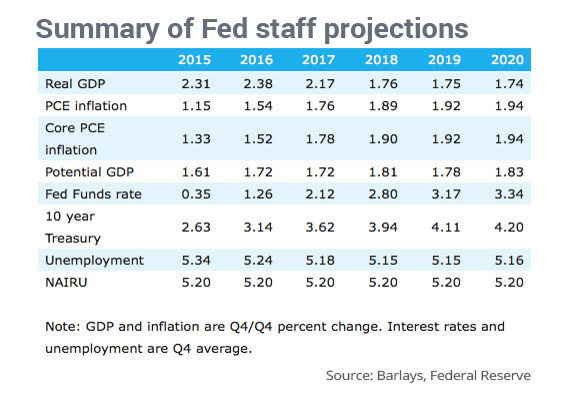

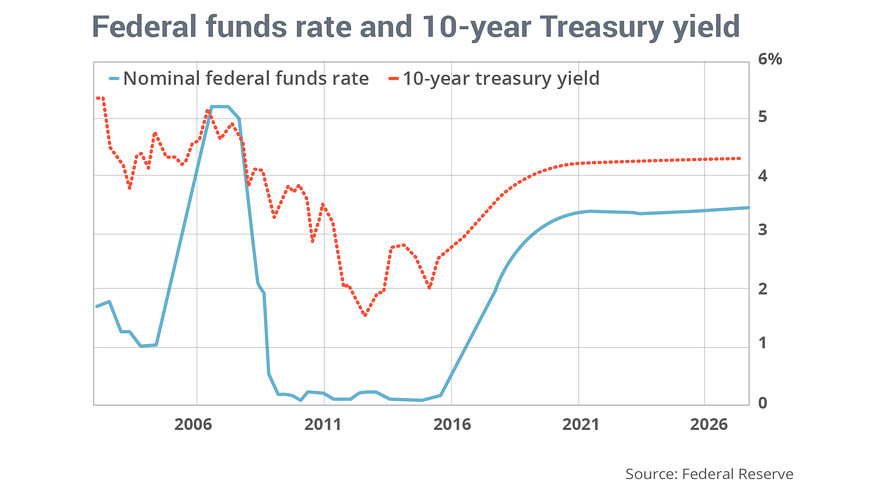

Fed staff expected the federal-funds rate to reach 0.35% at the end of this year, signaling that officials could raise rates once in 2015. Rates are seen reaching 1.26% at the end of 2016, and then climbing to 2.12% at the end of 2017. At the end of 2020, the rate is expected to reach 3.34%.

Fed staff forecast the unemployment rate to reach 5.34% in the fourth quarter, compared with 5.6% at the end of 2014. Looking further ahead, the staff expected the jobless rate to show little change, ticking down to 5.24% at the end of 2016 and 5.18% at the end of 2017. By 2020, staff saw the rate inching lower to 5.16%.

Inflation is expected to rise to 1.94% in 2020, slightly below the Fed’s target of 2%. The core inflation reading, which excludes the volatile categories of food and energy, is also expected to reach 1.94% by 2020.