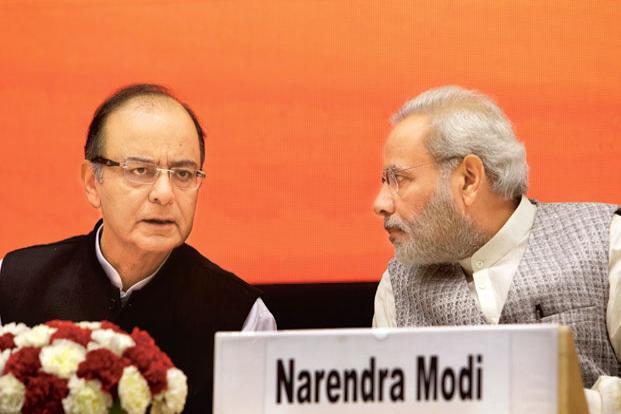

New Delhi: In the run-up to the Union budget, Prime Minister Narendra Modi will be meeting economists next week for feedback on the unfolding global and domestic economic scenarios.

Separately, finance minister Arun Jaitley will kick off his annual pre-budget consultation process with stakeholders ranging from bankers to trade unions.

The Prime Minister’s Office has tentatively scheduled the meeting with economists on 5 January.

“Prime Minister is keen to seek inputs from leading economists on stimulating sectors such as manufacturing, skill development and startups in the context of the Union budget,” a government official said on condition of anonymity.

“One of the questions Modi has for the guests is about ways to encourage private investments, considering that bank credit growth has been muted. There may be separate sessions on different topics.”

As part of his annual pre-budget consultations, Jaitley will first consult the agriculture group on Monday, followed by trade unions later on the same day. On Tuesday, he will meet the social sector-related groups in the morning and banks and financial institutions in the afternoon.

Eminent economists will submit their suggestions to the finance minister on Wednesday morning while industry lobby groups will do so later in the day. Jaitley will also, for the first time, meet software and hardware information technology companies as part of his budget consultation process.

Separate units of the finance ministry have been asked to provide talking points for Jaitley two days before the meetings and submit the minutes of the meetings a day after, a finance ministry official said on condition of anonymity. The official added that there could be last-minute change in the schedules of the meetings.

Meanwhile, the government has also sought suggestions from the public on the upcoming budget through the MyGov website.

In end-February, Jaitley will present his third budget, including the interim budget he unveiled after the National Democratic Alliance government came to power in May 2014.

Expectations are that the finance ministry is struggling to balance its books in 2016-17 after it was required to fund higher wage payouts and strong capital expenditure, even while it pursues fiscal consolidation; next year it has committed to begin reducing the corporate tax rate and implementing the goods and services tax (GST).

The Seventh Pay Commission proposed a 23.55% increase in emoluments for 4.7 million government employees and 5.2 million pensioners, which will pose an additional financial burden on central government coffers to the tune of Rs.1 trillion in 2016-17.

Jaitley is targeting lowering the fiscal deficit to 3.5% of gross domestic product (GDP) in 2016-17 from the budgeted 3.9% for the current fiscal year ending 31 March. He had deferred the previous government’s fiscal consolidation road map by a year in his last budget.

The main challenge before the government will be how to boost real GDP growth, as nominal growth is expected to be close to real GDP growth if inflation based on the GDP deflator remains close to zero like at present, said D.K. Srivastava, chief policy advisor at EY India.

“A lower nominal GDP print will have serious implications for indirect tax buoyancy and negatively impact the fiscal situation of both for the centre and the state governments,” he added.

Nominal GDP in the September quarter grew 6% as Wholesale Price Index-based inflation contracted, while real GDP grew 7.4%.

Srivastava said the other issues that the finance ministry will have to make up its mind on are the blueprint for the reduction in corporate tax rates and whether to further increase the service tax rate given its plan to peg the GST rate at around 18%.

The finance ministry increased the rate of service tax from 12.36% to 14% in June. It also imposed a Swachh Bharat cess of 0.5% on all services from 15 November.

Srivastava, however, believes the government is unlikely to let up on fiscal consolidation, as it could hurt its credibility.

To meet higher requirements for infrastructure finance, next year’s Union budget is likely to place greater emphasis on public-private partnership (PPP) projects to make up for a shortfall in investment spending by a resource-strapped government, Mint reported on 9 December citing finance ministry officials.