New Delhi: Facing fierce competition from Chinese phone makers, Micromax Informatics Ltd is focusing more on building its services ecosystem, which it expects will contribute the most to the company’s revenue by 2020.

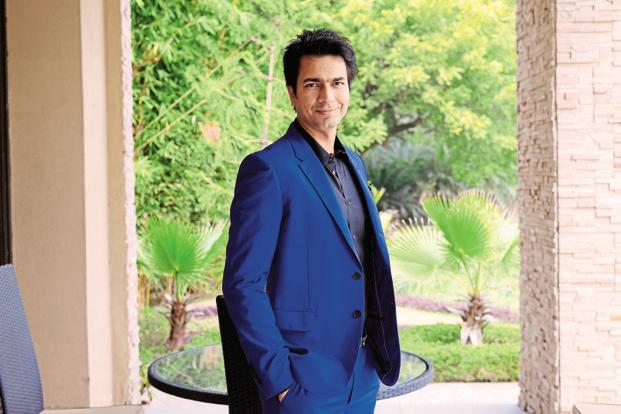

The company, which has introduced a suite of services called ‘Around’ in its Yu brand of phones, is now looking to incorporate it in most of its devices in the next three months, co-founder Rahul Sharma said. It expects to sell 50 million devices in the current financial year.

The Gurgaon-based firm will embed the services ecosystem in its new in-house operating software, which is to be launched in the next four months.

The company has been working on building its own operating system for over a year now. Some say this is one reason why Micromax’s deal with Alibaba fell through in October 2015 (mintne.ws/1jS2IG5). The Chinese e-commerce giant had been close to buying a 25% stake in Micromax, a deal that pegged Gurgaon-based Micromax’s valuation at $3.5 billion in June.

‘Around’ will be available in more than 80% of Micromax’s handsets barring a few low-end phones with less storage space.

The move comes at a time when the India market has been flooded by low-cost Chinese handsets, making it difficult for one company to dominate the segment and build brand loyalty among customers.

Services are increasingly becoming a key strategy for new handset manufacturers, who sell the hardware at minimal or no profit margins but expect the consumers to use the inbuilt services and pay per use.

“It is all about owning the customer… handsets have become a commodity today, there are similar features being offered at similar prices. Services might not generate revenues immediately or directly but these companies are building an ecosystem of services to win the customer first and then monetize eventually. If successfully built, services have proven to be a value-margin business than hardware for companies across the globe,” said Raja Lahiri, partner at Grant Thornton India.

India is yet to see strong adoption of content among customers who are willing to pay for such services.

Most phone manufacturers around the globe get a large share of their revenue from mobile applications, software and other bundled products that offer better profit margins.

Such services also increase customer stickiness and can be an important differentiator.

“We are changing our strategy from where we were two years back,” said Sharma. “Last year we saw all our Chinese friends coming in… there has been an onslaught. Everyone is trying to displace and disrupt the other with a pricing war and high marketing spends. As the hardware space becomes crowded, we want to focus more on strengthening our services play.”

It may not be as easy as that.

Micromax’s Chinese counterparts too have services strategies. Late last month, the newest Chinese entrant LeEco committed to invest $10 million over the following nine months towards setting up in-house content delivery networks in 10 cities across India. China’s Xiaomi led a $25 million investment in digital media firm Hungama Digital Media Entertainment in order to build its services ecosystem in the country.

Sharma believes Micromax is way ahead in the game.

As part of its strategy to build an integrated mobile ecosystem, over the past 12-15 months, Micromax has invested in eight to 10 start-ups, including mobile payments firm TranServ that will help the smartphone manufacturer to launch its own mobile wallet, allowing consumers to buy a wide range of services using its native payments solution.

Micromax plans to make eight more investments in start-ups in the artificial intelligence, healthcare, gaming and entertainment areas, according to Sharma. These investments could range anywhere between $1 million and $20 million, he added.

Last year, Micromax invested in Gaana, an online music streaming service operated by Times Internet Ltd, price comparison platform Scandid, and MiMedia Inc., a cloud service provider.

The company also bought into digital fitness app HealthifyMe (Caeruz Ventures Pvt. Ltd), and mobile travel search firm Ixigo (Le Travenues Technology Pvt. Ltd).

‘Around’ is largely powered by the same companies. Going forward, Micromax expects to tie up with independent service providers in travel (local cabs, flights, hotels), food and other categories.

For starters, Micromax plans to make money by charging a commission on every transaction that happens via its services platform. Eventually it will consider opening the platform to advertisers.

Over time, it will also introduce its own content in order to create new revenue streams. Sharma did not share a timeline for this.

Micromax, which closed 2015-16 with $2 billion in revenue, is expecting to grow by 30-40% this year.

According to the company, it sold close to 36 million devices during the year ended March 2016 and plans to sell close to 50 million phones in the current financial year.