New Delhi: The government on Thursday effected a regime makeover for oil and gas exploration in the country.

For one, it has prospectively replaced the existing profit-sharing arrangement in hydrocarbon exploration with a revenue-sharing formula.

And in another, it put in place a transparent single licence and policy framework for oil, gas and coal-bed methane exploration in the country. At present there is a different policy for each form of hydrocarbons.

The revenue-sharing formula may help prevent future disputes over pricing and cost recovery of the kind the government has been embroiled in with Reliance Industries Ltd (RIL).

The government also freed gas pricing from the new blocks and existing discoveries which are yet to commence production. However, to protect user industries from any unexpected spikes in gas prices, the government is imposing a price cap linked to the opportunity cost of imported fuels.

These changes are part of the overhaul undertaken by the Union cabinet to incentivise oil and gas exploration by operating a transparent policy regime, improve energy security by reducing dependence on imports and minimizing government intervention—consistent with the strategy of the National Democratic Alliance (NDA) in improving ease of doing business.

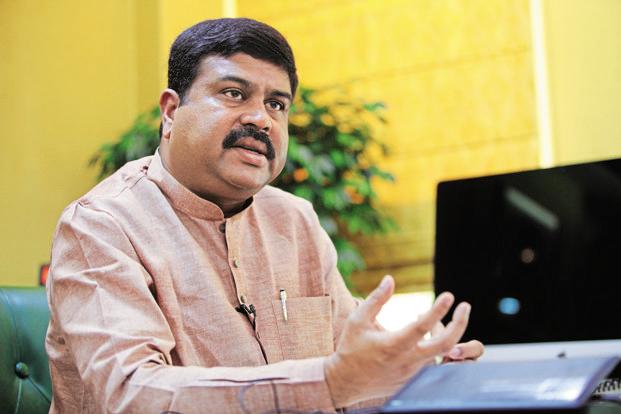

Briefing reporters after the cabinet meeting approved the Hydrocarbon Exploration Licensing Policy (Help), oil minister Dharmendra Pradhan said the new contractual regime for energy exploration is in line with the principle of “minimum government and maximum governance”.

The new hydrocarbon licensing regime allows pricing and marketing freedom for all forms of hydrocarbons to be produced from a field and for earnings to be shared with the government under an upfront revenue sharing formula.

This replaces the current system of allowing producers to first recover most of their costs and then start sharing revenues with the government.

The government adopted the revenue share model after the Comptroller and Auditor General of India (CAG) suggested that the cost-recovery model tempts companies to frontload spending and delay paying the state its share of profits.

Pradhan said the existing regime has led to disputes. The government’s move to disallow cost recovery by RIL from the KG D6 field revenue after the company’s gas output decline led to a dispute that is now in arbitration.

According to the petroleum ministry, the move to a revenue share will minimize government intervention. This is because until now, at every stage, the government has had to sign off on the costs claimed by the developer. This often triggered disputes and delay in the project.

Blocks are auctioned at present under the existing new exploration licensing policy (Nelp) to the bidder who offers to recover the least amount of cost upfront and offers a higher share of revenue to the government.

In the future, blocks will be licensed out to explorers on the basis of who offers the highest share of upfront revenue to the government.

The next round of auctions will happen under the new system when the government finds market conditions favourable.

“Under the new regime, the government will not be concerned with the cost incurred and will receive a share of the gross revenue from the sale of oil, gas etc.” said an official statement, adding that the idea was to improve ease of doing business.

While the new licensing policy simplifies the exploration process for future auctions of blocks, the new pricing formula for difficult-to-extract gas will benefit companies such as Oil and Natural Gas Corp. Ltd, RIL and Gujarat State Petroleum Corporation that have deep sea discoveries in already licensed blocks which are yet to be brought into production.

The new formula will encourage them to develop their deep sea discoveries and realize a price higher than what gas from other fields fetches now ($3.8 per unit).

“Today’s decision is expected to improve the viability of some of the discoveries already made in difficult geological areas and also would lead to monetization of future discoveries,” Pradhan said.

The idea is to incentivise new investments into the gas economy and boost supply and competition, which will eventually lead to lower gas prices. Till then, the ceiling price to be determined by landed cost of alternative fuels like fuel oil, liquefied natural gas and naphtha, will protect user industries such as power, steel and fertilizers.

BP Plc., which has a 30% stake in 23 oil and gas blocks in India, welcomed the move, saying these forward-looking initiatives will give a much needed impetus to the oil and gas industry.

“It demonstrates the government’s firm intent to transform the oil and gas sector and enhance import substitution. We believe this should help unlock the development of existing gas discoveries, and encourage additional exploration. It will also lead to the development of a competitive gas market in the country,” said BP in a statement.

The company also said the decision to deregulate gas prices could unlock production from new developments in deep, ultra-deep water and high-pressure, high-temperature areas.

An RIL executive, who did not wished to be named, welcomed the move and said the decision paves the way for a level-playing field between domestic and imported gas. Over a period of time, this concession should be extended to producing fields too, said the person.

Since the new pricing regime for deep-sea gas applies to undeveloped fields, gas from RIL’s KG D6 field in the Krishna Godavari basin which went on production in 2009 will not benefit from the decision.

“The price for deep sea gas would be determined by the weighted average of imported coal, LNG and naphtha”, said Pradhan. This ceiling price will be revised every six months. With this, as much as 6.75 trillion cubic feet of reserves, capable of producing 35 million standard cubic metres of gas per day (mmscmd) for 15 years, would get monetized, said the minister. These reserves are valued at Rs.1.8 trillion, he said.

The intent to introduce a new pricing formula was announced by finance minister Arun Jaitley in his 2016-17 budget speech.

At present, natural gas price is determined by taking into account the average of prices in gas-surplus countries such as the US, Canada and Russia.

“The proposed formula is market-efficient. By allowing competition to set prices it offers early entrants the most incentive, while the variable price cap will attract more exploration when global fuel prices go up,” said Kameswara Rao, leader of energy utilities and mining at PricewaterhouseCoopers in India.

‘Help’ will also allow energy companies to produce whatever form of hydrocarbon is available from a licensed block—coal bed methane, shale gas/oil, tight gas and gas hydrates—without seeking separate permission for producing each of the fuels.

Also, under the new regime, there will not be yearly auction of a cluster of identified blocks. Instead, investors can access data about all the blocks available and would be encouraged to bid at any time of their choice under the open acreage principle.

To help energy firms operating small- and medium-sized fields and for which the lease is to expire before full utilization of production rights, the cabinet said their tenure may be extended under revised terms.

This policy will cover 28 fields. This will help developers make fresh investments in those fields and improve oil recovery.

During the extended period, the government will claim 10% more share of revenue than what is applicable under the existing agreement.