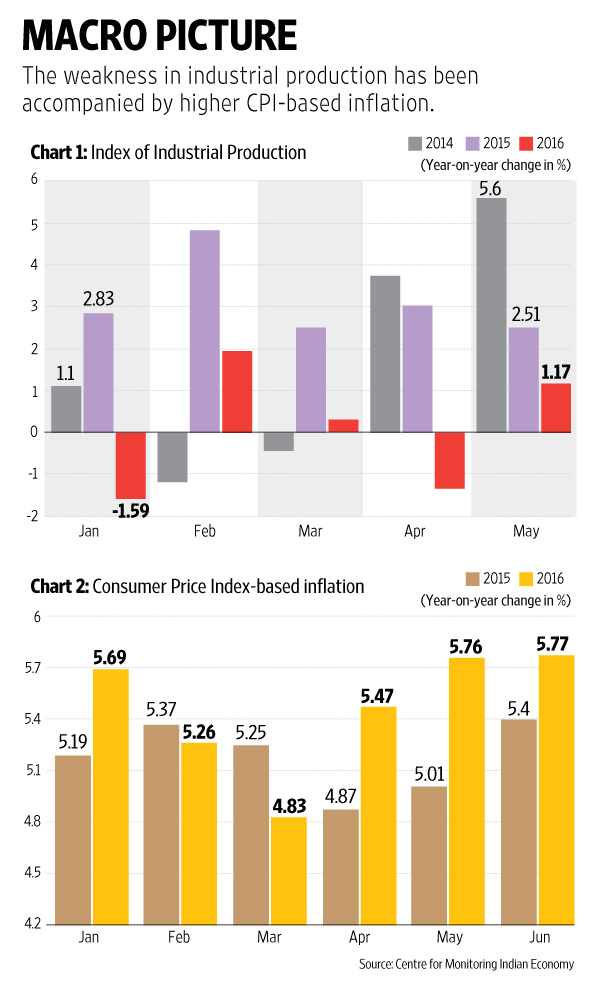

Why is the government so desperate to reduce interest rates? There’s a very good reason. The IIP (Index of Industrial Production) data shows that industrial growth in the first five months of 2016 has been lower than in the same period last year. Nor is that the whole story. As chart 1 shows, average growth during January-May 2016 was also lower than during the same period two years ago, during January-May 2014.

The worst hit is investment demand, with capital goods production, according to IIP, contracting sharply from a year ago. And it’s not just cumulative—growth in capital goods has been negative year-on-year every month so far in 2016. That is true for consumer non-durables as well—IIP data shows that production of consumer staples has contracted in the first five months of 2016 from a year ago. Only consumer durables production has held up industrial production this year.

The problem is that the weakness in industrial production has been accompanied by higher Consumer Price Index (CPI)-based inflation. Chart 2 shows that average consumer price inflation during the first half of 2016 has been higher than during the same period last year. In particular, inflation has been considerably higher during the three months to June.

Nor is it only food inflation that is higher. Inflation in the “miscellaneous” section, which includes household goods and services, health, transport and communication, education, recreation and personal care, has also been higher this year than in 2015, although it has been lower in June. Housing prices too are climbing faster this year than in 2015. In June 2016, for example, housing prices rose 5.46% from a year earlier, compared with 4.48% in June 2015.

As the Reserve Bank of India (RBI) pointed out in its last monetary policy statement, there are upside risks to inflation from the pay hike for central government employees as well as from higher commodity prices. But a new RBI governor, who will probably be a dove on inflation, may decide not to let that stand in the way of pushing the industrial recovery with a rate cut.