Since the start of the millennium, Latin American economies have thrived, as China’s expanding factories bought boatload after boatload of oil, copper, and other raw materials.

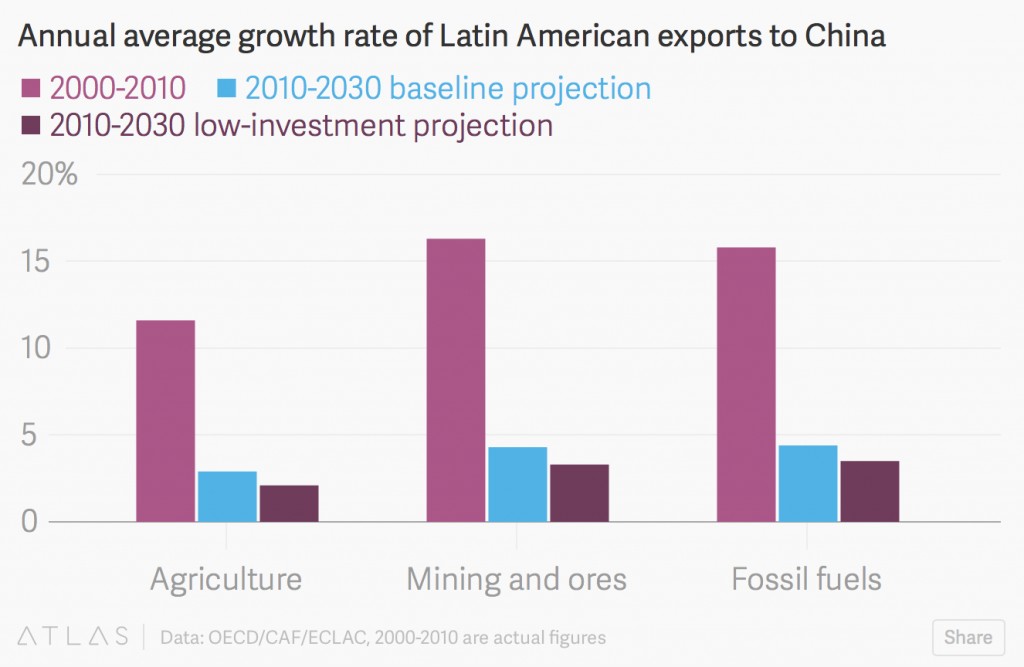

But Latin America’s commodity exports to China will slow sharply in coming decades, according to a study released Dec. 11 by three international bodies. And that will put a brake on the region’s economies.

As it grew its industrial sector, China became a major partner for Latin America. Trade between the two multiplied 22-fold between 2000 and 2013, according to the report. China is the biggest trading partner of the region’s largest economy, Brazil, as well as of Chile and Peru.

But now, with China growing more modestly, its demand for commodities has dropped—and so have their prices. And those raw materials account for more than 70% of Latin America’s exports to China, according to the report.

Latin American countries are already suffering from a decline in business. Last year, trade between the region and China fell by 2% in value, the report states. And, it says, the slowdown is not a temporary blip.

As consumption by China’s middle class replaces industry as the country’s main economic driver, commodity exports will grow at a much slower pace at least until 2030. Mining countries, such as Chile and Peru, will be hit particularly hard.

Because Latin American economies came to depend so much on the windfall of those exports, they are now in withdrawal. After growing at annual average of 5% last decade, the region’s GDP as a whole expanded by only 1% in 2014, and is expected to shrink in 2015, the agencies said.

But there is a silver lining, the OECD’s secretary general, Angel Gurría, said during a speech. “The word ‘crisis’ is represented with a character that at the same time implies ‘opportunity,’” he said.

To profit from China’s transformation, Latin American countries should add value to the products they already sell, the report says. Instead of marketing crops in bulk, farmers could process them into ready-to-eat products to feed China’s bulging middle class, developing their own brands to stand out. (Chile is already doing that with wine.)

China’s economy also offers the chance of going into completely different lines of business. Latin American firms could start offering back-office services to the country’s global companies, or medical services to its aging population. The region’s urban planners can help lay out new cities, and its architects, to build them, the report suggests. Then there’s tourism. Although Chinese visitors to Latin America have grown in recent years, they only make up a sliver of the country’s tourist trade. But to achieve all that, Latin America will first have to improve its workers’ skills and its infrastructure, Mr. Gurría said.