The world’s biggest money manager said Brazil must do all that it takes to maintain its investment-grade credit rating if it wants to remain an attractive destination for foreign capital.

Robert Kapito, BlackRock Inc.’s co-president and co-founder, said that while his firm wants to promote Brazil to its clients, most of them won’t be interested in investing in the country if it’s downgraded to high-yield junk.

“Focus on credit quality and make sure to do everything that you can not to have a downgrade so that we can continue to promote Brazil as a great place to invest,” Kapito, whose firm has $4.6 trillion in assets under management, said at an event hosted by BM&FBovespa SA in Campos do Jordao.

The advice from the New York-based investment firm comes as President Dilma Rousseff struggles to win lawmakers’ support for measures aimed to shore up fiscal accounts and avoid a third rating cut under her administration. Moody’s Investors Service reduced Brazil’s rating to the lowest level of investment grade earlier this month, citing a shrinking economy and the political outlook, while Standard & Poor’s cut the outlook on its BBB rating to negative from stable on July 28.

Brazil’s gross domestic product contracted 1.9 percent in the second three months of the year from the previous quarter, the national statistics agency said in Rio de Janeiro on Friday. That is more than analysts had forecast, as tighter monetary policy and faster inflation torpedoed confidence and caused activity to nosedive.

“When I manage money for large institutions and for retail investors, they give me guidelines of how far down in the quality spectrum I can go,” Kapito said. “So even though I may feel optimistic about the country, the guidelines don’t allow me to invest money if the rating is at certain level.”

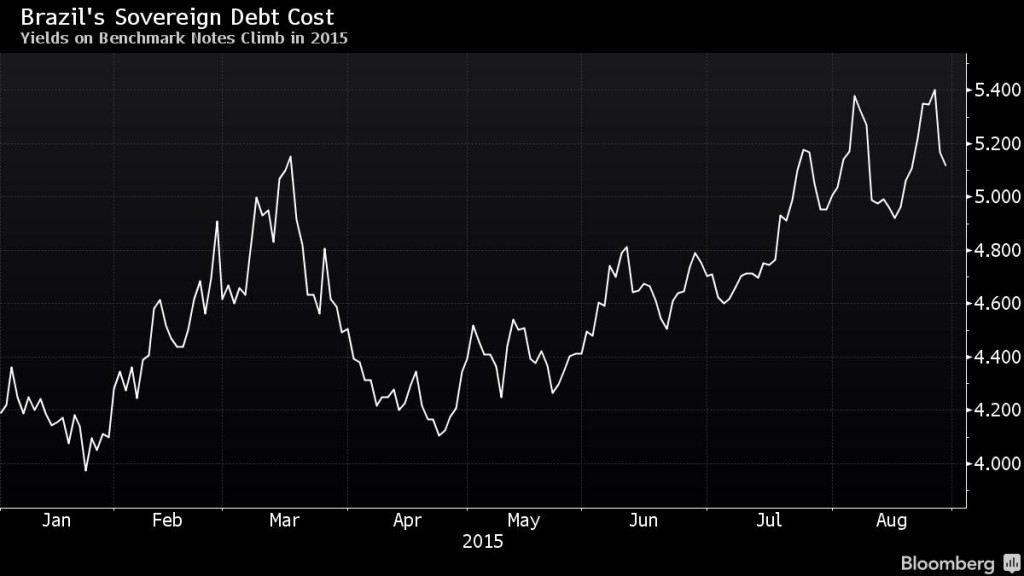

A rating cut would lead to higher costs of funding for the federal government and companies, he said. Yields on Brazil’s $4.3 billion of notes due in 2025 have risen 0.9 percentage point this year to 5.1 percent. The increase is more than twice the average for developing nations.