South Africa’s currency is suffering and its government bonds are sinking for the ninth consecutive day, with the latest nerves following a downbeat assessment of the country by both Standard and Poor’s and Fitch.

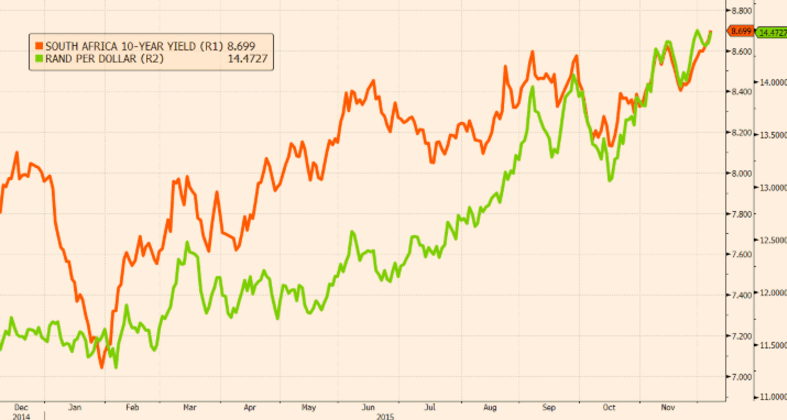

South Africa’s 10-year rand-denominated government bond yield has climbed (meaning prices have dropped) 6 basis points (or 0.06 percentage points) this morning to a near-two-year high of 8.72 per cent. That’s its ninth straight day of losses, writes Joel Lewin.

Since January the yield has surged 166 bps as the slump in commodities and emerging market currencies has hurt South Africa’s mining-focused economy.

The dollar has leapt 0.8 per cent against the rand this morning, to a near record high of 14.438 rand to the dollar. The buck has been buoyed by a strong jobs report on Friday, which intensified expectations of a December Fed rate hike, and the woes of the South African economy.

S&P cut its forecast for South African GDP growth in 2016 to 1.4 per cent from 2.1 per cent in June, and warned:

South Africa’s pace of economic growth remains slow. External demand is weak, with low commodity prices, and the country faces domestic constraints including an inadequate electricity supply and overall weak business confidence inhibiting substantial private sector investment.