A spurt in services sector activity offset a contraction in the manufacturing sector in December 2015. As a result, the seasonally adjusted Nikkei India Composite PMI Output Index, a gauge of private sector activity both in the services and manufacturing sectors, showed an improved reading of 51.6 compared with 50.2 in November.

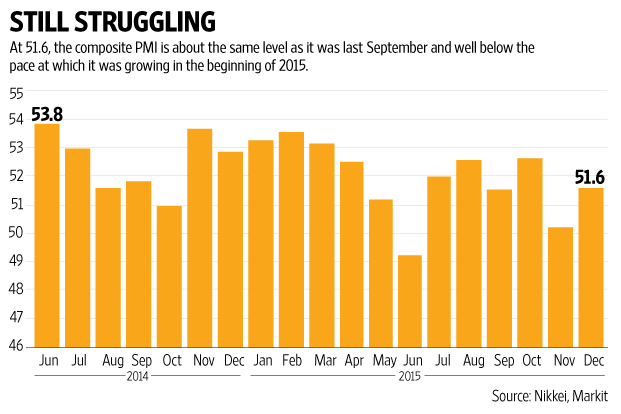

The services sector is insulated from the chill deflationary winds blowing from China, which could account for its bounce. The chart shows that at 51.6, the composite PMI isn’t exactly going great guns—it’s about the same level as it was last September and well below the pace at which it was growing in the beginning of 2015. That’s why Markit economist Pollyanna De Lima says “Overall, the PMI data continue to portray a struggling economy, weighed down by weak underlying demand. Indeed, cost inflation continues to surpass charge inflation, highlighting the intense competitive environment.”

Nevertheless, since much of the fall in the manufacturing PMI was due to the floods in Chennai, the manufacturing gauge should do better in future and that should pull up the composite PMI. The chances of the bounce in the services sector being sustained are high, given the solid increase in new business. Survey respondents also said increased demand enabled them to pass on some of their rising costs. That ties in with other evidence of robust urban consumer demand, partly the result of falling inflation and partly the effect of lower interest rates.

However, the boost to consumption may be tempered this year, as the impetus provided by falling fuel prices wears off. That could be why, in spite of some improvement, the Business Expectations Index of the services PMI recorded its second lowest reading in the history of the survey in December, highlighting a weak degree of confidence.