Chinese iron ore imports account for around two thirds of global seaborne iron ore shipments, making it the key driver of Capesize employment. While the hike in Chinese iron ore imports in the year to date has supported Capesize demand, there is great uncertainty over the sustainability of the growth in 2H 2016, the distribution of trade across different routes and the overall impact on Capesize requirement.

Opportunities For Capes?

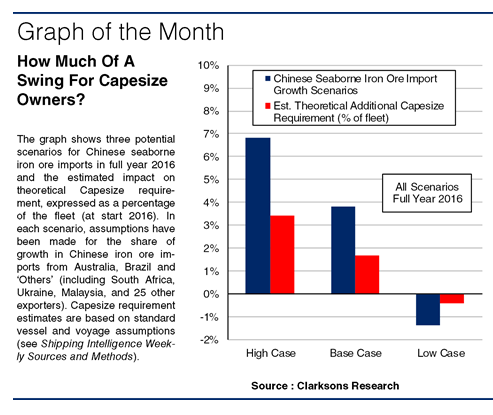

Chinese seaborne iron ore imports grew 6.6% y-o-y to 321mt in January to April 2016, supported by firm growth in long-haul trade from Brazil. This helped to absorb some of the significant oversupply of Capesize tonnage. However, there is great uncertainty regarding continued growth in China’s housing market, steel production and stockpiling, highlighting the broad downside risks to the country’s iron ore imports in 2H 2016. As such, there are a wide range of scenarios for Chinese iron ore import growth in full year 2016, the breakdown of trade flows, and the overall impact on Capesize requirement.

A Long-Haul, Long-Shot?

In a ‘high case’ scenario, Chinese seaborne iron ore import growth is projected to continue at roughly the levels recorded in the year to date, with long-haul shipments from Brazil increasing 21% in the full year, providing a significant boost to tonne-mile trade growth. In this scenario, Chinese iron ore imports from Australia and ‘Other’ exporters continue to grow at 3% and 4%, respectively. Overall, in these circumstances theoretical Capesize requirement would be boosted by an estimated 10.6m dwt (on the basis of standard vessel and voyage assumptions), equivalent to 3.4% of the start 2016 fleet.

A More Likely Scenario

However, there are broad expectations for easing Chinese construction activity and steel consumption in 2H 2016. A ‘base case’ scenario factors in these downside risks, with 0% y-o-y growth in Chinese iron ore imports projected in 2H 2016 and 3.8% in the full year. In this scenario, growth in Chinese iron ore imports from Australia and Brazil is more balanced, giving less weight to long-haul trade than in the ‘high case’. Under these circumstances, Capesize requirement would rise by around 6m dwt, equating to 1.8% of the fleet.

A Potential Turn For The Worse

In a more negative scenario, iron ore shipments from Australia and Brazil remain static, while exports from ‘Others’ drop by 9%. Overall, a downturn in the country’s property market and significant cuts to steel output in 2H 2016 contribute to Chinese seaborne iron ore import demand dropping 1.4% in full year 2016. This would reduce Capesize requirement by around 1.3m dwt, or 0.4% of the fleet.

So, as the ‘base case’ seems the most likely of the scenarios, given the firm start to the year, and the Capesize fleet is expected to contract by 0.4% in 2016, China could be providing some positive news for owners. However, a great deal of uncertainty remains. Clearly, trends in 2H 2016 will be watched closely, given the central role that Chinese iron ore import growth still plays for Capesize requirement.