Each sub bureau of NFCRC, the foreign currency management office of Beijing and Chongqing; The foreign economy and trade committee(office,bureau)of each province,municipality,directly jurisdictional city and independently development planning city(including ministry of Shenzhen trade development),each foreign trade center, directly affiliated company of each ministry:

In order to improve the exporting quality, strike the conducts of ducking our of or cheating foreign currency, prevent our country’s foreign currency’s out flowing and assess the import & export enterprises’ collecting foreign currency behavior with the process of enlarging the export, national foreign currency regulation committee, along with ministry of foreign trade and economy cooperation, have made out “the trying examine measure of collecting the foreign currency” and handed out to you. Please conduct according to it.

This measure will come into implementation from May 1st, 1999. The examine time of the first quarter is postponed from the first ten days of May to first ten days of June. And the period of examining export foreign currency colleting remains to be from January 1st, 1999 to March 31st, 1999. The period of examining rate of bill handed in remains to be from October 1st, 1998 to December 31st, 1998. Please hand in the first assessing result to the bureau general in time and the result is confined in the use of the foreign currency regulation committee instead of publicize it. From the second examination in August in 1999, all the conducts should abide with this notice.

Each foreign currency regulation bureau must examine the estimated foreign currency collecting time,estimated collecting amount and other such data declared by the import & export enterprises according to related codes, must make good work of data inputting and statistic, must ensure the good operation of computer system, must assure the quality and accuracy of the writing-off data of foreign currency collecting.

While understand the soul of “the trying examine measure of collecting the foreign currency” in real earnest, be sure to make good work of propaganda. After receiving this notice, every bureau should transmit it to its affiliated bureaus,designated foreign currency banks(including foreign banks) and related units as soon as possible. Foreign economy and trade unit transmit this notice to its affiliated foreign trade company.

Attachment:

“the trying examine measure of collecting the foreign currency”

ATTACHMENT:

the trying examine measure of collecting the foreign currency

CHAPTER I GENERAL PRINCIPALS

Item 1 In order to perfect collecting foreign currency management,supervise enterprises’ collecting foreign currency fully,write-off in good time and keep the balance of international income and expenses, the measure has been made out according to ,< the statute of foreign currency management of PROC>,etc.

Item 2 The measure is applied to every kinds of enterprises holding the privilege of import & export (below using the abbreviation of import&export enterprises)including foreign companies(including joint venture of foreign trade between foreign and national capitals),manufacturing enterprises of self-supporting import&export,commercial material companies,foreign service-contracting companies ,process trade companies,border trade companies,traveling small -amount trade companies etc.

Item 3 The examine of collecting the foreign currency adopts the measure of quarterly examination and annual examination. The result of examination applies to the system of aviso and publication. The scope of report is foreign trade and economy departments ,customs,;banks and tax regulation departments.

Item 4 Foreign currency administration and its branches (including Beijing and chongqing foreign currency regulation departments9 below using the abbreviation of foreign currency bureau) are responsible for the organization and implementation of specific examination and appraising.

CHAPTER 2 THE YARDSTICKS OF EXAMINATION

Item 5 The export foreign currency colleting rate is the main yardstick of examination of collecting foreign currency in export.

Item 6 The export foreign currency colleting rate refers to the result of the amount having been written -off in the export amount that should be written-off to the export amount that should be written-off in the period of examination. The equation is below:

the amount having been written -off in the export amount that should be written-off(that is:

The amount that has been written -off +the written -off that doesn’t behave as t he manner of currency +the authorized marginal written -off)

Export foreign currency colleting

rate=—————————————————————x100%

The export amount that should be written-off in the period of examination

The export amount that should be written-off in the period of examination doesn’t include the amount that should be written-off but not before.

In the meantime ,the following collecting and writing -off amount should not be included in the amount having been written -off:(I):the amount that should be collected but not before ,which should be collected and written-off in this period;(II):the amount that has not reached the collecting period;(III):the actual collected amount that exceeds the export amount (the total trade amount ).

Item 7 that the rate of letter delivery comes up to standard are the basic requirements of assessing the classes of import & export enterprises’ collecting foreign currency and writing-off. The rate of letter delivery is the number of stubs that has been returned among the drawn letters of collecting currency and writing-off in the examination period (below using the abbreviation of letter of writing-off) to the result of the drawn letters of writing-off minus the amount that has been written off(not including the amount of reporting loss). The equation is below:

The rate of letter delivery =( The number of stubs that has been returned among the drawn letters of collecting currency and writing-off in the examination period)/(The drawn letters of writing-off minus the amount that has been written off (not including the amount of reporting loss) in the examination period)x100%

CHAPTER 3 THE MEASURE OF EXAMINATION

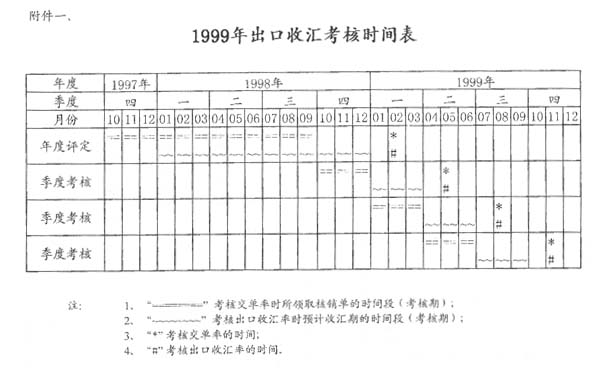

Item 8 The examination of export collecting currency includes quarterly examination and annual examination. The period of quarterly examination is a quarter, in the the first ten days of May ,August and November in each year ,the export collecting currency rate in this year’s first quarter ,second quarter ,third quarter and last year’s fourth quarter additional to the rate of letter delivery in this year’s first and second quarter should be examined respectively. The period of annual examination is a year, the export collecting currency rate in the year before last year’s fourth quarter and last year’s first quarter ,second quarter ,third quarter additional to the rate of letter delivery in total last year should be examined in each year’s first ten days of February.(see attachment 1)

Item 9 The standard of export collecting foreign currency examination.

1. The standard of export collecting foreign currency examination is 70%, on this basis, there are four classes:

(1) Export collecting foreign currency rate reaches or exceeds 95%;

(2) Export collecting foreign currency rate is between 70%(including 70%) and 95%;

(3) Export collecting foreign currency rate is between 50%(including 50%) and 70%

(4) Export collecting foreign currency rate is below 50%.

2. The examination standard of the rate of letter delivery is 80%.

Item 10 Assessing the class of import & export enterprises’ export collecting foreign currency according to the results of examination in annual examination.

1. When the rate of export collecting foreign currency reaches or exceeds 95%, the enterprise is evaluated as the honorary enterprise of export collecting foreign currency;

2. When the rate of export collecting foreign currency is between 70%(including 70%) and 95%, the enterprise is evaluated as the up-to-par enterprise of export collecting foreign currency;

3. When the rate of export collecting foreign currency is between 50%(including 50%) and 70%, the enterprise is evaluated as the risky enterprise of export collecting foreign currency;

4. When the rate of export collecting foreign currency is below 50%, the enterprise is evaluated as the high- risk enterprise of export collecting foreign currency;

The basic requirements of assessing the class of import & export enterprises’ export collecting foreign currency is the rate of letter delivery reaches 80%, if not, they are be evaluated as the risky enterprise of export collecting foreign currency.

Item 11 The standard of export collecting foreign currency examination can be adjusted by NFCA and MFTAE according to the specific conditions in different period.

Item 12, Examination of receiving foreign exchange when export should implement classified system. National foreign exchange committee and MOFTEC are responsible for quarter examination and annual assess of center imports and exports enterprise. Branch of national foreign exchange committee and the same grade department leaded by MOFTEC are responsible for quarter examination and annual assess of local imports and exports enterprise.

Item 13, every foreign exchange committee should count up the number of cancel and verification of receiving foreign exchange when export before the date 15 this month when it finished examination. Meanwhile, it should fill in < Table of assessing receiving foreign exchange of imports and exports enterprise> (accessory 2) and < Statistics of assessing receiving foreign exchange of local exports> (accessory 3) and report to upper foreign exchange committee. < Table of assessing receiving foreign exchange of imports and exports enterprise> (table 1: enterprise invested by Chinese capital) must be sent to the same grade department leaded by MOFTEC.

Every provincial foreign exchange committee should gather < Table of assessing receiving foreign exchange of imports and exports enterprise> and < Statistics of assessing receiving foreign exchange of local exports> made by branch bureau and itself before the date 15 this month when it finished examination. Meanwhile, it should fill in < Table of assessing receiving foreign exchange of imports and exports enterprise> (accessory 2) and < Statistics of assessing receiving foreign exchange of local exports> (accessory 3) and report to national foreign exchange administer committee. Electronic number of the two table should also report to national foreign exchange administer committee by net of system communication in foreign exchange committee. In addition, < Table of assessing receiving foreign exchange of imports and exports enterprise> (table 1: enterprise invested by Chinese capital) must be sent to the same grade department leaded by MOFTEC.

Item 14, reporting and publicizing the result of examination and assess of receiving foreign exchange when export. National foreign exchange administer committee and MOFTEC are responsible for reporting < Table of assessing receiving foreign exchange of imports and exports enterprise> (table 1: enterprise invested by Chinese capital) made by every central imports and exports enterprise every quarter and reporting “honorary enterprise of receiving foreign exchange” and “high venture enterprise of receiving foreign exchange” in local annual assess and publicizing them in the relevant medium.

Every provincial foreign exchange committee and deportment leaded by MOFTEC are responsible for reporting < Table of assessing receiving foreign exchange of imports and exports enterprise> (table 1: enterprise invested by Chinese capital) made by every imports and exports enterprise. They should also reporting “honorary enterprise of receiving foreign exchange” and “high venture enterprise of receiving foreign exchange” in annual assess and publicizing them in the relevant medium.

Charpt4 rewards and punishment

Item 15 bureau of foreign exchange and branch in charge of foreign business give rewards and punishment to enterprise of imports and exports by result of annual assess.

(1), “honorary enterprises in experts and accepting foreign exchange” enjoy the favorable policy and simplify procedure in managing taches.

(2), for “venture enterprises in experts and accepting foreign exchange” and “high venture enterprises in experts and accepting foreign exchange”, bank should strictly grasp procedure of providing a loan.

(3), warn against “venture enterprises in experts and accepting foreign exchange”

(4), MOFTEC or branch in charge of foreign business accredited by MOFTEC will prohibit some enterprises, which is honored “high venture enterprises in experts and accepting foreign exchange” in one year or ” venture enterprises in experts and accepting foreign exchange” in a couple of years.

Item16 bureau of foreign exchange and branch in charge of foreign business will follow up and check the “venture enterprises in experts and accepting foreign exchange” and “high venture enterprises in experts and accepting foreign exchange” in emphases. If experts and imports enterprises disobeyed the regulation of foreign exchange, bureau of foreign exchange and branch in charge of foreign business would give them punishment according to relevant regulation.

Charpt5 supplementary articles

Item 18, steps of rewards and punishment to result of quarter assess of bureau of foreign exchange will taken according to paragraph 1 ,2 and 3 of Item 15 , Item 16 andItem 17.

Item 19, this measure will be explained by managing bureau of foreign exchange and MOFTEC

Item 20, if the former regulation is contrary to this measure, we will admit this measure.

Item 21, this measure will be implemented from 1st,5 1999.

Accessory 1,

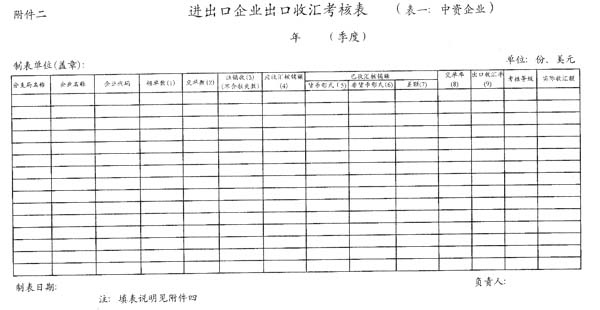

Accessory 2,

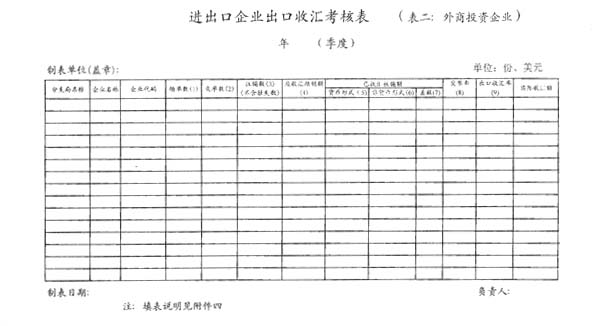

Table of assessing accepting foreign exchange of imports and exports enterprise (table 2:enterprise invested by foreign business)

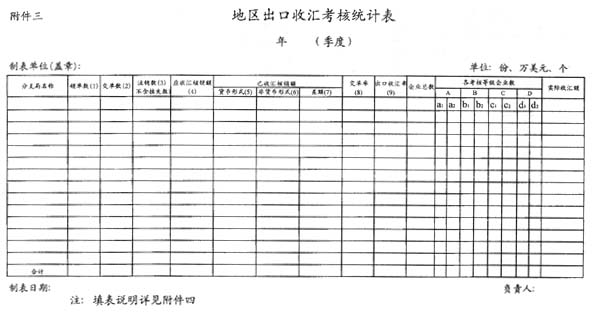

Statistics of assessing accepting foreign exchange of local exports.

Accessory 4

First, Introduction on how to fill in

1,(table 1) is for enterprises invested by Chinese capital

< Table of assessing accepting foreign exchange of imports and exports enterprise> (table 2) is for enterprises invested by foreign business.

2, (8)=(2)/[(1)-(3)]X100%;

(9)=[(5)+(6)+(7)]/(4)X100%;

3, column of “rank of examination”: in the table of quarter examination, “A” means rate of accepting foreign exchange when exporting exceeds 95%, “B” means rate of accepting foreign exchange when exporting is from 70% (including 70%) to 95%, “C” means rate of accepting foreign exchange when exporting is from 50% (including 50%) to 70%, means rate of accepting foreign exchange when exporting is under 50% or rate of delivering bill is under 80%. In “A”, “B”, “C”, there is not inclusive of these enterprises whose rate of delivering bill is under 80%.

In the table of annual examination, “A” means “honorary enterprise of accepting foreign exchange when exporting”, “B” means “fulfillment enterprise of accepting foreign exchange when exporting”, “C” means “venture enterprise of accepting foreign exchange when exporting”, “D” means “high venture enterprise accepting foreign exchange when exporting”.(table 2: enterprise invested by foreign business) is filled in as the former measure. But it doesn’t mean rank assessed.

4, in column of ” receiving value of foreign exchange canceled after verification”, we should fill in expected total value of exports during the period of examination.

5,in column of “received value of foreign exchange canceled after verification”, we should fill in value of exports finished the procedure of receiving value of foreign exchange canceled after verification during the period of examination, not including excessive receiving, late receiving and early receiving.

6, in column of “actually received value of foreign exchange canceled after verification”, we should fill in actually received value of foreign exchange during the period of examination, including excessive receiving, late receiving and early receiving, not including value of foreign exchange canceled after verification and value of balance canceled after verification which are not in currency form.

7, in column of “enterprise code”, national standard enterprise code awarded by national technology supervise branch should be filled in.

8,imports and exports enterprises arrange in turn as “A””B””C” and “D”.

second, Introduction on how to fill in < Statistics of assessing accepting foreign exchange of local exports>

1, (8)=(2)/[(1)-(3)]X100%;

(9)=[(5)+(6)+(7)]/(4)X100%;

2, “total number of enterprises”=A+B+C+D, A=a1+a2,B=b1+b2,C=c1+c2,D=d1+d2,”a1”, “b2”, “c1”, “d1” respectively means enterprises invested by foreign business.

In statistics of quarter examination, “A”; means rate of accepting foreign exchange when export exceeds 95%, “B” means rate of accepting foreign exchange when export is from 70% (including 70%) to 95%, “C” means rate of accepting foreign exchange when export is from 50% (including 50%) to 70%, “D” means rate of accepting foreign exchange when export is under 50% or rate of delivering bill is under 80%. In “A”, “B”;, “C”, there is not inclusive of these enterprises whose rate of delivering bill is under 80%.

In the table of annual examination, “A” means “honorary enterprise of accepting foreign exchange when exporting”, “B” means “fulfillment enterprise of accepting foreign exchange when exporting”;, “C”; means “venture enterprise of accepting foreign exchange when exporting”, “D” means “high venture enterprise accepting foreign exchange when exporting”. Enterprises invested by foreign business fill in the table as the former measure. But it doesn’t mean rank assessed.

3, in column of ” receiving value of foreign exchange canceled after verification”, we should fill in expected total value of exports during the period of examination.

4,in column of “received value of foreign exchange canceled after verification”, we should fill in value of exports finished the procedure of receiving value of foreign exchange canceled after verification during the period of examination, not including excessive receiving, late receiving and early receiving.

5, in column of “actually received value of foreign exchange canceled after verification”, we should fill in actually received value of foreign exchange during the period of examination, including excessive receiving, late receiving and early receiving, not including value of foreign exchange canceled after verification and value of balance canceled after verification which are not in currency form.