New Delhi: The resilience of the Indian economy will be tested by an unfavourable global environment and slow investment recovery even though positive policy actions along with a decline in oil prices have helped make the country the fastest-growing large economy in the world, the International Monetary Fund (IMF) said on Wednesday.

Despite reduction in imbalances and strengthening of buffers, the impact from intensified global financial market volatility could be disruptive for India, including from unexpected developments in the course of the US monetary policy normalization or China’s growth slowdown, IMF said in its annual Article IV consultation report released on Wednesday, preceding the presentation of the budget for 2016-17. However, the impact on India will be relatively modest given its weak trade linkages, it added.

India was one of the least affected emerging market economies following the China spillover episode in the summer of 2015, the report said. “Market differentiation during the China spillover episode is found to largely reflect a country’s commodity dependence (as a percent of its total exports), direct trade exposure to China, and macroeconomic fundamentals, such as inflation and current account imbalances. India is a net commodity importer and has small trade exposure to China, hence is not directly affected via the commodity price or trade channels,” it added.

India’s exports to China account only for 3.85% of the total, while imports constitute 13.5% of overall imports.

Since the taper tantrum in 2013, India has made significant progress in reducing inflation and its current account deficit—as a result, much reduced domestic and external vulnerabilities also played a role in shielding India from this bout of market volatility, the IMF said.

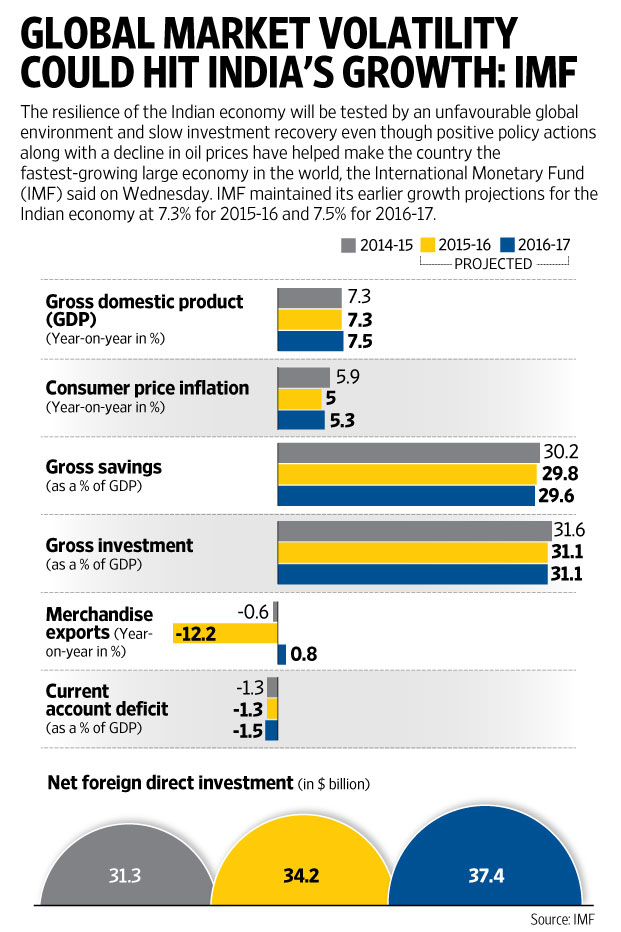

Retail inflation is expected to average 5% in 2015-16, from 9.4% in 2013-14, while a fall in merchandise imports may help narrow the current account deficit to 1.3% of gross domestic product in 2015-16 against 1.7% of GDP in 2013-14, the IMF said.

However, India’s financial vulnerabilities lie in elevated corporate leverage and stressed assets, as well as eroded banking sector buffers, it said.

“Low profitability, coupled with high leverage, has put a strain on firms’ debt repayment capacity. Stress tests of corporate balance sheets suggest that their exposure to potential shocks has continued to increase. Importantly, the weaker position of domestic corporates has also accounted for a substantial deterioration of banks’ asset quality. Stress test simulations suggest that potential capitalization needs should be manageable, but may require additional fiscal outlays,” the IMF said.

The Union budget has allocated Rs.25,000 crore for the recapitalization of state-owned banks in 2016-17.

The IMF said India will have to continue to rely on domestic demand as its key source of growth. “Increasing capital buffers in public banks, which in our assessment is manageable even in a severe stress scenario, and implementing governance reforms in public sector banks along with the new bankruptcy law, are of key importance to ensure the durability of the Indian growth recovery,” said Paul Cashin, head of the IMF team for India.

Domestic risks include continued weaknesses in corporate financial positions and public bank asset quality, as well as setbacks in the reform process, which could weigh on growth, accelerate inflation and undermine sentiment.

On the upside, further structural reforms could lead to stronger growth, as would a sustained period of low global energy prices.

IMF maintained its earlier growth projections for the India economy at 7.3% for 2015-16 and 7.5% for 2016-17. The Economic Survey in February projected GDP to grow between 7-7.75% in fiscal 2017, while the statistics department has estimated the economy will grow at 7.6% in 2015-16.

The IMF said it will be a challenge for India to sustain its growth momentum as private investment continues to show only a few signs of revival.

“Project implementation and supply-side challenges have been a drag on corporate investment for several years and as they have chipped away at the financial strength of core industrial sectors, so the investment recovery is likely to be sluggish,” Cashin observed.

The report suggests the government should endeavour to increase tax revenues, including through better revenue administration. In addition, overhauling India’s food and fertilizer subsidy schemes through better targeting and further efficiency reforms would save substantial funds, the IMF said. “In this regard, the long-planned goods and services tax is a priority, as it would create a single national market, enhance the efficiency of intra-Indian movement of goods and services, and boost GDP growth,” its report held.