1. Customs legislation consists of:

1) the Customs Code of the Customs Union;

2) international treaties of the states – members of a customs union, regulating customs relations in the customs union;

3) The decisions of the Commission of the customs union, regulating customs relations in the customs union, passed in accordance with the Code and international treaties of the states – members of the customs union.

General provisions on customs payments

Customs payments include:

1) import customs duty;

2) export customs duty;

3) value added tax, charged for the goods importation into the customs territory of the customs union;

4) excise tax (excise taxes), charged (charged) for the goods importation into the customs territory of the customs union;

5) customs fees.

General provisions on the customs declaration of goods

1. Goods subject to customs declaration for placing under the customs procedure or in other cases established in accordance with the Customs Code of the customs union.

2. Customs declaration of goods is made by the declarant or customs representative acting on behalf of the declarant.

3. Customs declaration is made in writing and (or) electronic forms using the customs declaration.

Federal Customs Service (FCS of Russia) is an authorized federal body of executive power, exercising functions for the frame of public policy and legal regulation, control and supervision of Customs in accordance with the laws of the Russian Federation (the official site www.customs.ru).

Taxes and charges legislation

Tax and charges legislation of the Russian Federation consists of the Tax Code of the Russian Federation and passed federal laws on tax and revenue.

SYSTEM OF TAXES AND CHARGES IN THE RUSSIAN FEDERATION

In the Russian Federation the following types of taxes and charges are established: federal, regional and local.

Federal taxes and charges are:

1) Value Added Tax;

2) excise taxes;

3) individual income tax;

4) profit tax;

5) mineral extraction tax;

6) water tax;

7) fee for the right of use of fauna and water biological resources;

8) The state fee.

Regional taxes are:

1) Property Tax;

2) tax on gambling;

3) Transportation tax.

Local taxes include:

1) land tax;

2) personal property tax.

Federal Tax Service (FTS of Russia) is a federal executive authority exercising functions of control and supervision over legislation observance on taxes and charges (the official site www.nalog.ru).

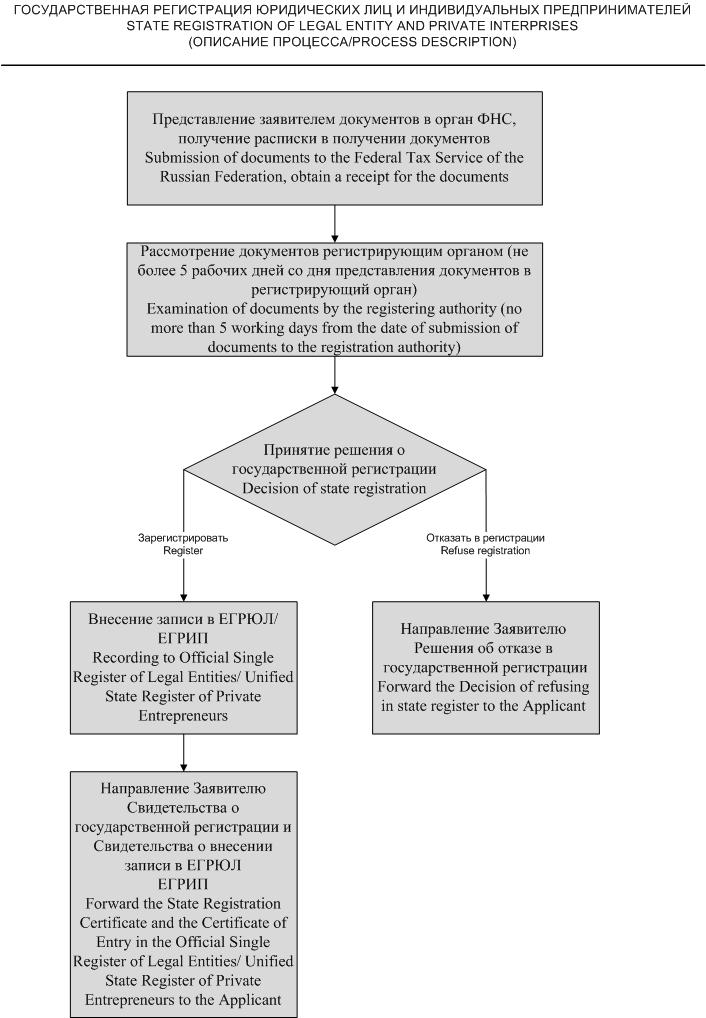

REGISTRATION OF LEGAL ENTITY

1. Reason for registration

Legal entity subject to state registration with the authorized government body in the manner, determined by the state registration of legal entities law. Data about state registration are included in the Uniform State Register of legal entities, open to public studying.

Course of business without state registration as a legal entity entails administrative liability in st.14.1 Administrative Offences Code of the Russian Federation, and if this act caused major damage to citizenry organizations or state or involved the generation of income on a large scale, then – criminal penalties for st. 171 Criminal Code of the Russian Federation.

2. Where to go

Authorized government agency implementing the registration of legal entities, is the Federal Tax Service of the Russian Federation.

3. Terms

Duty for state registration is charged in the manner and amount determined by the Tax Code of the Russian Federation.