Lack of innovation has been one of the key weaknesses to the current Chinese economy. To a great extent this problem has resulted from the economic decentralization as Chinese provincial governments have been granted autonomy in running local economies.

Lack of innovation has been one of the key weaknesses to the current Chinese economy. To a great extent this problem has resulted from the economic decentralization as Chinese provincial governments have been granted autonomy in running local economies.

With increased power, in particular the revenue from land sale, Chinese provincial governments are able to bargain hard with the central government in setting up industries perceived to be profitable. The relaxed control on foreign direct investment after China’s WTO entry facilitated such local orientated projects access to foreign technology and markets through incorporation with multinationals.

For example, in the automotive industry despite repeated affirmations by the central government to support a few major car makers, the majority of 31 Chinese provinces have built up their own car manufacturers with the involvement of multinationals. Assembling vehicles on foreign supplied technology and key components is the most convenient way to expand. Despite that, the total Chinese investment in the automotive industry is far more than that of the Korean automotive industry; it has not transferred into breakthroughs in technology as the investment has been diluted into numerous assembling plants in different provinces.

This problem is common to almost all Chinese manufacturing industries fully open to market competition and foreign investment which explains the fact that 70% of the technology, equipment and machinery and 80% of the key components required for innovative products in China are imported.

To find solutions enabling capital to bypass local governments has become urgent. Deployment of what is called a multilevel capital market is one of the key steps taken by the central government in this regards.

The function of this multilevel capital market is highly focused on the establishment of investment funds specifically dedicated to targeted strategic industries. The Chinese government, a main contributor, and some selected provincial governments are taking the initiative in setting up such funds. State owned financial institutions such as policy banks, insurance companies and major state owned corporations are instructed to put money in. Participation of private capital is also encouraged. These funds will then be listed on the stock market in order to raise more capital.

The development of IC (integrated circuit) industry, which is one of the priorities listed in the government strategy of “China manufacturing 2025,” demonstrates how this multilevel capital system is working.

The National Integrated Circuit Industry Investment Fund (NICIIF) was established in September 2014, with contributors ranging from state policy bank, provincial governments such as Shanghai and Beijing to some major state owned corporations. Through the issue of ordinary and preferred shares, NICIIF raised capital up to 130 billion yuan by December 2014. As a commercial entity a professional team has been hired to run the fund.

Since its establishment, NICIIF, over the next 5 years, has engaged strategically in the Chinese IC industry. such as the equity investment in Semiconductor Manufacturing International Corporation valued at 4.7 billion yuan and 10 billion yuan in Unigroup.

The financial input by NICIIF has enabled leading Chinese corporations to carry on mergers and acquisitions domestically and internationally. Unigroup, China’s largest IC designing company acquired Nasdaq-listed Spreadtrum Communications and RDA Microelectronics in 2014. Recently Unigroup signed an acquisition deal to buy a 15% stake in US data storage company Western Digital for $3.78 billion. The acquisitions by Chinese companies of Singapore based STATS ChipPAC ltd and OmniVision, a US supplier of chips for image sensor for IPhones, are also of international influence.

The executive of Huaxin Investment Management which manages NICIIF estimated that in the next 10 years NICIIF could trigger total investment up to 5 trillion yuan to the Chinese IC industry which is projected to be expanding at a rate of 20% annually in the next 5 years.

NICIIF demonstrates that though the government influence remains strong, its operation, which is controlled more by professionals rather than government officials, is mainly in response to market conditions. The investment conducted by NICIIF has been highly concentrated on leading Chinese corporations and in China’s most advanced regions geographically.

The performance of NICIIF might lead to a major breakthrough in dealing with the government driven and local orientated pattern in national fixed investment, which is the root of various problems to the Chinese economy such as overcapacity, lack of motivation in innovation and dependence on foreign technology.

To an extent, NICIIF serves as a pilot project as the Chinese government is keen to extend the use of capital markets for strategic objectives. Shanghai has been particularly highlighted in this task as the investment funds of a similar nature in NICIIF are being set up for industries from airliner manufacturing, electric cars, biochemical, brain technology and nuclear power for new material.

Mess entrepreneurship and innovation

Separation between research institutions, universities and industries is a key factor contributing to low rate of commercialization of invention in China which is only 30%. In contrast it is between 60-70% in advanced economies.

The buildup of an innovative economy means that China has to strengthen connections between R&D institutions and industries and promote entities and individuals taking initiative in innovation.

To lay down regulations that permit inventors to register their intellectual properties as a stake in their startups and to purchase such stakes through government guided equity investment funds, effectively turns the invention into capital and is the policy combination widely deployed by the government at all levels to stimulate innovation and commercialization of inventions.

The creation of Loongson Technology (Dragon-Chip in Chinese) is one such story.

Hu Weiwu, was a researcher working on CPU in the Institute of Mathematics, Chinese Science Academy. Aiming at promoting commercialization of the Dragon CPU which he and his team developed, the institute encouraged Hu to set up a company by taking advantage of the policy that permits the conversion of intellectual propriety into equity.

Consequently Lonngson Technology was established with the initial investment made by Chinese Science Academy and a state owned corporation.

In order to maximize profit, creation of a fertile ecosystem for the use of Dragon CPU has instinctively become the priority since the establishment of Loongson Tech. By investing in coordination with suppliers and customers of hardware and software, Loongson Tech has made significant advancement in marketing. The sale of Dragon CPU in 2013 was 18 thousands units, it increased to 350 thousands last year and is expected to double this year. Now, there are over 10 thousand researchers and engineers developing IT products based on Dragon CPU.

The operation of Beijing Institute of Collaborative Innovation (BICI) is another pattern where public funding is provided to encourage individuals and public or private entities to commercialize their inventions.

BICI was jointly funded by the Beijing government, top Chinese universities in Beijing and the Chinese Science Academy in 2014. The highlight of BICI is that while half of its total spending is used for operations of its 18 research centers, the other half is allocated to 18 corresponding investment funds.

Upon successful completion of research projects, the core of the research team is offered the opportunity of setting up businesses in collaboration with outside investors. While outside investment should cover at least 10% of the cost for the commercialization of the project, the rest will be met by the investment fund under BICI.

Consequently a pathway is built for the commercialization of innovation between research institutions and industries.

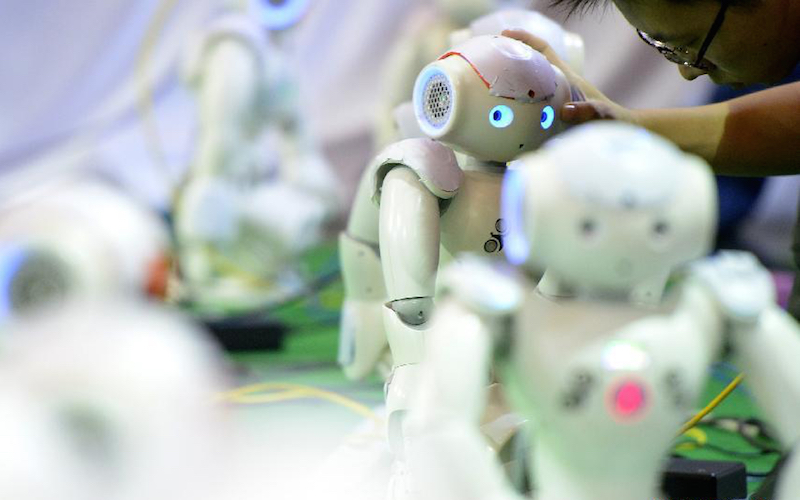

In 2015 the total funding for BICI is expected to reach 1.5 billion yuan. BICI has invited 75 top scientists to set direction for its research centers. So far 268 professors and a large number of engineers and interns have been recruited for 66 projects covering computing technology, robotic, advanced manufacturing, new material, new energy automobiles, advanced medicine, electronics and many other fields. In order to recruit quality applicants and prospective projects BICI is setting up branches in several major cities in China and in Silicon Valley in the USA.

The government push for commercialization of innovation is far beyond the Lonngson and BICI pattern. In Shenzhen inventors from state owned universities and laboratories can be rewarded with up to 60% of the profit within 5 years of their innovation being commercialized. Government funds up to 1 million yuan to domestic institutions and 10 million to overseas institutions can be made available for the commercialization of their invention in Shenzhen.

Startups are eligible for generous tax deductions, rental subsides, access to key equipment in state institutions, provision of key data and information and matching service with businesses.

The reduction of entry barriers and easier access to finance has made setting up businesses a fact for millions of ambitious researchers, teachers and students.

The massive government push for innovation has had a positive impact on the Chinese economy. In the first half of 2015, the growth of high tech industries reached 10.5%, much faster than the industrial average. The expansion of profitability of corporations in 27 strategic innovative industries continued at a rate of 20% in the first 5 months in 2015.