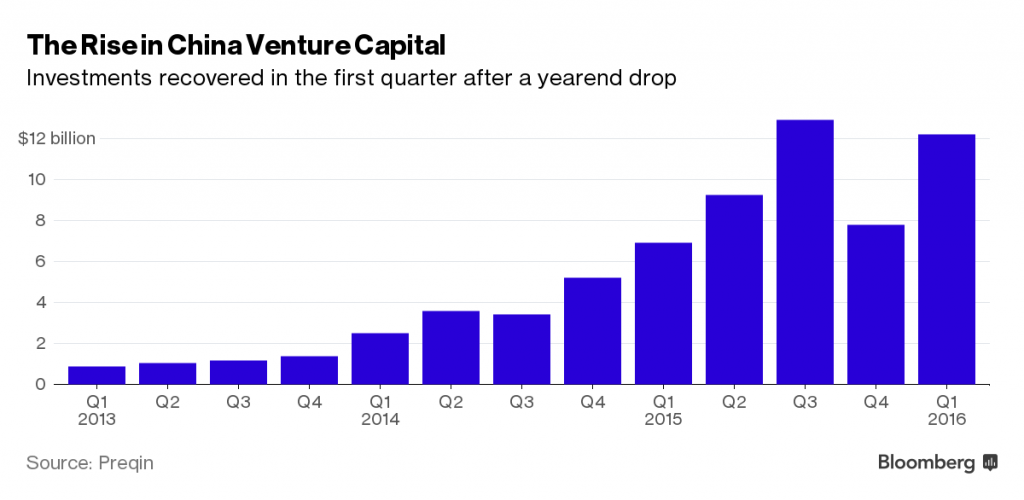

Venture capital investments in China and India surged in the first quarter, recovering from a downturn late last year and driving a global increase in venture financing.

The value of venture deals in China and India rebounded to $12.2 billion and $1.6 billion respectively in the first quarter, up by about 50 percent from the last quarter of 2015, according to London consultancy Preqin Ltd. Globally, the value of deals reached about $34 billion in the first quarter, compared with about $27 billion the previous period.

The decline in venture deals in the fourth quarter had fueled questions about a bubble in tech investing, particularly as investors wrote down the value of stakes in high-profile startups such as Snapchat Inc. and India’s Flipkart Pvt. The first quarter recovery signals venture investors are putting such concerns on hold, at least for now.

“There’s been a more rational approach in recent months given the market volatility,” said Felice Egidio, head of venture capital products at Preqin, in e-mail. The increase in deal value is “a mark of investors’ confidence.”

Last year was a record for venture deals globally. Venture funding rose 45 percent to a record $135.8 billion, according to Preqin. The value of deals in China more than doubled to $37 billion.

Still, venture funding fell sharply in the fourth quarter, dropping to about $27 billion from about $42 billion in the third quarter of last year. The value of China venture deals fell to $7.8 billion in the fourth quarter from $13 billion.

In the first quarter, the four biggest deals were all in China. The largest was the $3.3 billion financing for Meituan-Dianping, the company created from the merger of the group-buying site Meituan.com and the customer-review site Dianping.com.