The rupee is stronger than most people think!

Source: freefincal | Original Published At: 2025-05-28 00:30:33 UTC

Key Points

- INR depreciation against USD has significantly slowed in the last two decades

- Forex rates determined by actual/expected demand-supply dynamics for USD

- Trade deficit historically weakens INR, but recent trends show improved stability

- Long-term depreciation rate (3-4%) now below India's personal inflation rates

- Potential shift in global currency dominance with BRICS countries mentioned

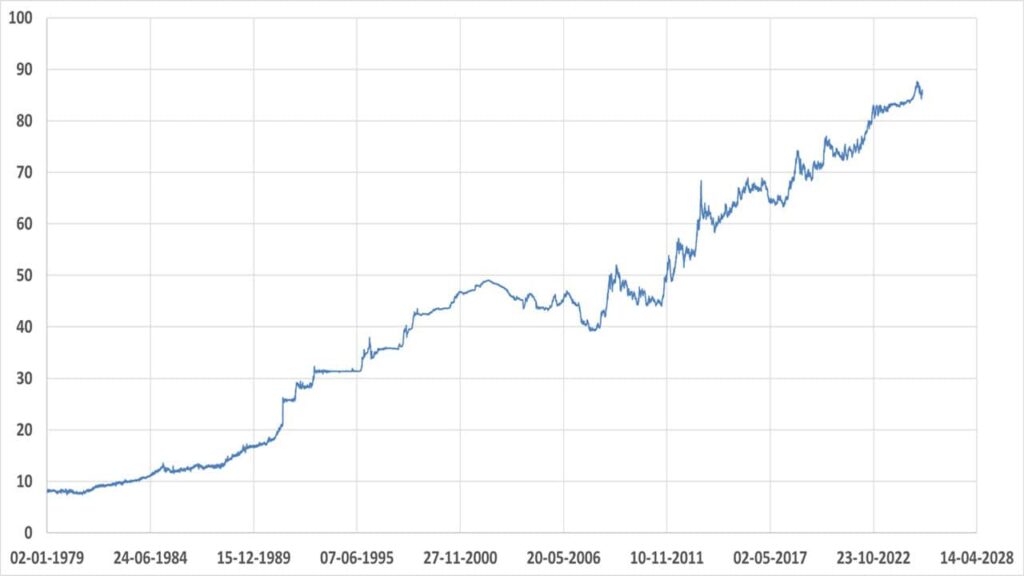

Over the years, especially in the last two decades, the INR has been relatively resilient against the USD compared to its past performance. As our economy grows, we should have more faith in our currency. Before we look at the data, let us understand why the Rupee fluctuates in value against the US Dollar.

Note: I am only trying to point out that the rate at which the INR depreciated against the USD has significantly decreased in the past two decades. Therefore, it is important to keep expectations in check, especially concerning gold returns and international equity/bond returns. Also see: What you need to know about gold before investing in it

Like there is an equity market, bond market, commodities market (gold, silver, oil, cotton, etc.), money market, there is also a forex market. That is, like all other markets, two factors determine USD-INR rates. (1) The actual demand for dollars vs supply for dollars and (2) the expected (speculated) demand vs supply for dollars.

There is plenty of speculation in the forex market about how future demand and supply for dollars will pan out, and the Rupee will fluctuate against the Dollar. We are most concerned about INR-USD because most of our financial inflows and outflows are in USD.

If there is an actual or expected inflow of foreign capital (in Dollars), the rupee will strengthen. That is, the INR per USD rate will decrease. Examples are FII investments (debt or equity) and higher exports.

Conversely, if there is an actual or expected outflow of Dollars, it will weaken the Rupee. That is, the Rs. per USD rate will increase. Examples are FII redemptions, Indians investing abroad, and higher imports (e.g., gold, crude oil). This will also increase inflation.

The net impact of actual and expected dollar supply vs. demand determines the daily INR-USD rate.

Companies that export goods and services (e.g., IT companies) will benefit if the Rupee falls, but at the same time, companies that require the import of foreign capital (debt) and raw materials will suffer. They will do well when the Rupee strengthens.

India has always been a net importer (imports > exports = trade deficit), resulting in the gradual depreciation of the Rupee against the Dollar. This is the historical balance of trade (exports minus imports) from Trading Economics.

While this does not paint a pretty picture, we must examine the exchange rate movement.

This is the drawdown (fall from a peak) of the exchange rate.

You can see that it often falls from a peak, and recently, the drawdowns have decreased in magnitude, signifying better stability. So, the depreciation is rarely smooth.

Let us now look at the exchange rate’s 5-year, 10-year, 15-year, and 20-year rolling returns.

While the 5-year and 10-year returns have ups and downs, the 15-year and 20-year returns have significantly reduced. This means the rupee has become significantly stronger in the last two decades or so.

As the economy grows, this trend will continue. Much like inflation, although it may have periods of intermittent increase, over time it will come down (as it has). It is a good sign that the current 3-4% long-term depreciation rate is well below personal inflation rates in India. I am sure these rates are much lower than what social media warriors imagine.

While India will not become a net exporter overnight, its exports are expected to grow reasonably in the future (I would expect close to twice the currency depreciation rate), stabilizing the INR.

Also, will the USD be a dominant currency in the next 20-30 years, or will the BRICS countries (Brazil, Russia, India, China, and South Africa) have a big say in the world order? I don’t know about you, but I will not bet against the INR.